CORPORATE INNOVATION BENCHMARK

The largest quantitative analysis of innovation activities by DAX30 and their US & China peers

Dr Joachim Faber

Chairman of the Board

Deutsche Börse

"It´s a significant step forward to now have data on how exactly companies address innovation and the results confirm our belief that there is ample opportunity to open up further to external innovation."

Christian Klein

CEO

SAP

"In addition to fostering our own strong internal innovation culture, M&A and corporate venture capital help us access top talent and innovation worldwide to complement our portfolio. We are proud to be recognized as a leader in this field."

Preview

Press release

Study "Future Made in Germany" compares innovation investments

Germany's largest companies lack focus on disruptive innovation

-

“Future made in Germany”, the new Corporate Innovation Benchmark has developed the largest quantified analysis of innovation investments by DAX corporates over the last 10 years

-

DAX 30 corporates spend 96% of their innovation budgets on internal resources focussing on incremental improvements, only 4% are allocated to external innovation driving disruption and growth

-

US and China peers are spending up to 50% of their budgets on external innovation such as Mergers & Acquisition, Corporate Venture Capital and Acceleration projects

-

Best practice examples such as SAP and Deutsche Börse in Germany, Alibaba and Tencent of China, Facebook and Alphabet in the US guide recommendations towards allocating a minimum of 10% of the total innovation budget on external innovation, primarily in M&A and Corporate Venture Capital

German DAX companies have for decades built market leading positions based on strong internal R&D teams. Their innovation and quality is what “Made in Germany” is known for all over the world. However across the globe market leaders with strong internal innovation bias have often missed disruptive technologies. There are examples world wide, such as Siemens vs Cisco for routers, Microsoft vs Google for operating systems, Nokia vs Apple on mobile phones, or BMW/Mercedes vs Tesla for electric vehicles, where incumbents have missed new markets worth hundreds of billions of Euros.

An analysis of the innovation activities of the DAX30 and their US and China peers uncovered 764 innovation projects over the period of 2008 to 2017 and investments of more than EUR1.1tr. The average DAX corporate invested 3.3% of revenues in innovation across internal and external projects. This compares to 5.6% within the US and 2.6% in the China peer group, positioning Germany ahead of China, but behind the US.

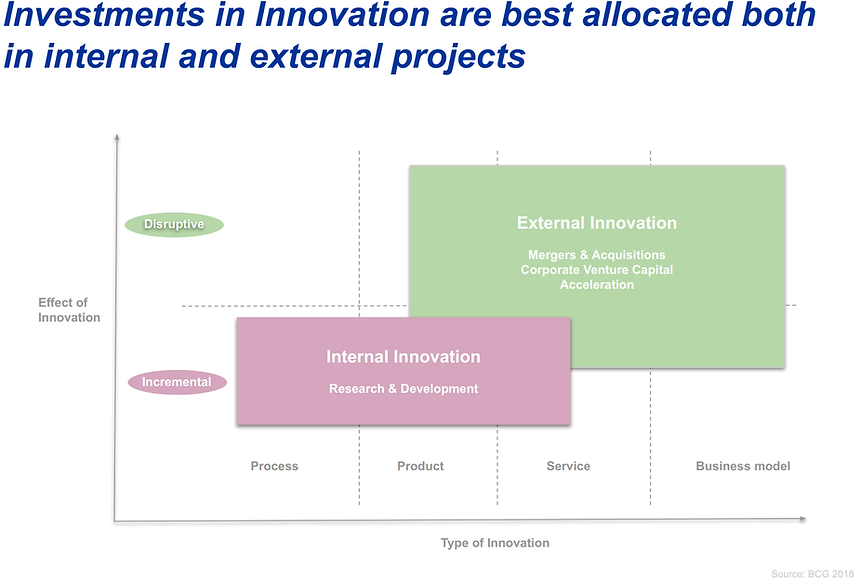

Internal vs external innovation

However more pronounced differences emerge in the respective allocation of the innovation budget into internal innovation, where internal R&D teams are focussed on product development and incremental innovation, and external innovation, where M&A and Corporate Venture Capital are driving disruptive innovation and growth. Today the DAX Corporations allocate 96% of their budget towards internal innovation and a mere 4% on external innovation.

This is in stark contrast to US and China peers. In China the largest companies invest more than 50% of their innovation budget towards external innovation. This is more than twelve times the amount of their DAX peers. Also US companies invest more than double the amount in external innovation with 9% of their budget focussed on disruptive projects.

Best practice

The most innovative companies of the DAX30 and their peers spend above 10% of revenue on innovation as a whole, with Alibaba of China taking the top spot at 45%. In the US Facebook reaches 37% and in Germany SAP is ranked 1st place with 17%.

In this group of companies, the average allocation towards external innovation is 23%. This budget is invested primarily across M&A and Corporate Venture Capital. Facebook, Tencent and Alibaba have each invested more than EUR10bn in M&A, whereas in Germany the top three DAX companies have spend EUR2.7bn (SAP), EUR700mio (Deutsche Börse) and EUR600mio (Bayer) on acquisitions of innovative start-ups.

Recommendations for the Board of Directors

Based on the learnings of the top ranked innovative companies across industries we derived the following recommendation to guide Boards through their decision making on external innovation:

-

Innovation Budget: Benchmark and increase share of external innovation within total innovation budget from 4% to 10%

-

External Innovation: Allocate 80% of external innovation budget towards M&A and 20% towards Corporate Venture Capital

-

Corporate Venture Capital: Early stage: Invest indirectly via independent early stage VC funds. Late stage: Invest direct in late stage Scale-Ups via own Corporate Venture Capital fund

-

M&A: Acquire late stage companies to disrupt existing and compete in adjacent markets and keep acquired companies as a separate business unit as long as feasible

“We are very excited to contribute our insights within the “Future made in Germany” report to the wider public discussion on innovation and our competitiveness against the United States and China. Our discussions with a wide array of DAX Board Members have validated the interest in the topic and an ambition to significantly expand the focus on external innovation. We welcome and encourage any further perspective and discussion on our findings.” says Matthias Hilpert, CEO of MH2 Capital. Matthias Hilpert, together with Johannes von Borries, Managing Partner, Unternehmertum Venture Partners and Christian Meermann, Founding Partner, Cherry Ventures, are co-authors of the “Future made in Germany” benchmark study.

“It´s a significant step forward to now have data on how exactly companies address innovation and the results confirm our belief that there is ample opportunity to open up further to external innovation. This will provide a step change in harnessing our innovative capabilities in Germany.” says Joachim Faber, Chairman of the Supervisory Board at Deutsche Börse Group.

“Success today depends on the ability to keep pace with technological innovations and the ability to develop new products and services but also enhance and expand existing ones. In addition to fostering our own strong internal innovation culture, M&A and corporate venture capital help us access top talent and innovation worldwide to complement our portfolio. This combination gives us a clear differentiation and competitive edge in today’s fast changing environment. We are proud to be recognized as a leader in this field”, says Christian Klein, CEO, COO and member of the Executive Board of SAP SE.

About Matthias Hilpert, MH2 Capital

Matthias Hilpert is a Private Investor in early stage technology, real estate and public assets. He founded avalas.com, Germany’s first mobile internet portal, out of university and spent more than 20 years in telecoms for Vodafone, Orange and Salt worldwide. In his last operating role he ran the Consumer Business of Orange Switzerland, a EUR 1bn P&L. In this capacity Matthias contributed to a successful Private Equity investment cycle for Apax Partners, generating EUR 800m enterprise value. As CEO of MH2 Capital he has turned into one of the most active Private Investors in Europe based in Berlin. Matthias studied Business Administration, Philosophy and Artificial Intelligence at FAU Erlangen-Nuremberg, University of Edinburgh and LMU Munich.

About Johannes von Borries, Managing Partner, UVC Partners

Johannes is an experienced VC and successful entrepreneur. He started his career in VC at Wellington Partners in 2001. After several years in the early German startup ecosystem Johannes founded NandaTech, a semiconductor equipment startup which he built up and finally sold successfully. After his exit he invested as Business Angel and In 2015 joined UVC Partners as Managing Director. Johannes holds a MBA from U.C. Berkeley and a Master in Industrial Engineering from TU Berlin. At UVC Partners Johannes invests in Industrial Technologies, B2B SaaS, and Mobility. Due to the partnership with UnternehmerTUM, UVC Partners can offer a large corporate network and access to technical talent.

About Christian Meermann, Founding Partner, Cherry Ventures

Christian is a Founding Partner at Cherry Ventures. After some years at The Boston Consulting Group, Christian joined Zalando as their first CMO. Christian was responsible for building up and managing the group’s marketing efforts (i.e. performance marketing, CRM, PR, TV and brand marketing). He then joined the Management Board of Peek&Cloppenburg and was responsible for the company’s online business. He holds a diploma in business administration from WHU – Otto Beisheim School of Management. He has lived and worked in the U.S., Spain, Brazil and South Africa. Christian gets excited about founders that are as passionate about execution as they are about building a strong and sustainable brand. He has a particular focus on logistics and mobility as well a food technology companies.

Kontakt:

Matthias Hilpert

CEO, MH2 Capital

Matthias.Hilpert@mh2capital.com

Berlin, November 2019